08 9322 1430 info@middleisland.com.au

Sandstone Gold Project

Sandstone Gold Project

Western Australia

The Sandstone project and processing facility is situated 12km south of the township of Sandstone, ~400km northwest of Kalgoorlie, and located on a sealed highway between the mining towns of Mt Magnet and Leinster in the East Murchison Mineral Field of Western Australia.

The Sandstone gold project comprises two granted Mining Leases on which the processing plant is situated. Middle Island has 100% interest in the nearby Wirraminna, Ned’s, Jew Well and Telegraph tenements. Middle Island has, or has the rights to, a 100% interest in mineral tenure comprising some 181km2. The Sandstone project also includes a 600,000tpa CIL processing plant, all associated infrastructure, an operating licence, permitted tailings storage facility and bore field, and three fully equipped camps located on freehold title within the nearby village of Sandstone (click on the Open Map tab to view tenement locations).

Table 1. Sandstone Project Tenements

| Tenure | Annual Rent 2020 | Annual Rates 2019 | Annual Form 5 Expenditure | Interest | Expiry Date |

|---|---|---|---|---|---|

| M57/128 | 19,500 | 18,232 | 97,500 | 100% | 26/09/2031 |

| M57/129 | 19,940 | 18,644 | 99,700 | 100% | 09/04/2031 |

| P57/1395 | 123 | 113 | 2,000 | 100% | 12/06/2025 |

| P57/1384 | 303 | 278 | 4,040 | 100% | 04/04/2024 |

| P57/1442 | 159 | 154 | 2,120 | 100% | 20/05/2023 |

| E57/1102 | 4,230 | 4,140 | 30,000 | 100% | 27/05/2024 |

| Total | 44,255 | 46,832 | 235,350 |

History

In excess of 1Moz of gold has been produced from surface, open pit and underground operations in the Sandstone area since the 1890’s. In addition to historic mining activities, more recent gold production is variously attributed to Herald Resources Limited in the 1990’s and Troy Resources Limited (Troy) from 1999 to 2010. Troy extracted and processed a combined total of approximately 4.4Mt open pit of ore at an average grade of 3.6g/t Au for production of 508,000oz gold before the operation was placed on care and maintenance in September 2010.

Southern Cross Gold Limited (SXG) acquired the Sandstone project from Troy in December 2012 with the primary objective of relocating the processing plant to its Marda Project some 100km to the south. A subsequent merger of SXG and Poly Metals to form Black Oak Minerals Limited (Black Oak) diverted focus to Poly Metals’ NSW assets before Black Oak was placed into administration in September 2015 and subsequently liquidation in February 2016.

Middle Island acquired a 100% interest in the Sandstone Project from the Receivers of Black Oak in July 2016 for a consideration of A$2.5M, comprising a A$250,000 deposit, a A$1.25M completion payment, a A$500,000 deferred payment (paid in December 2017), and a A$500,000 payment contingent on recommissioning of the processing plant.

Geology

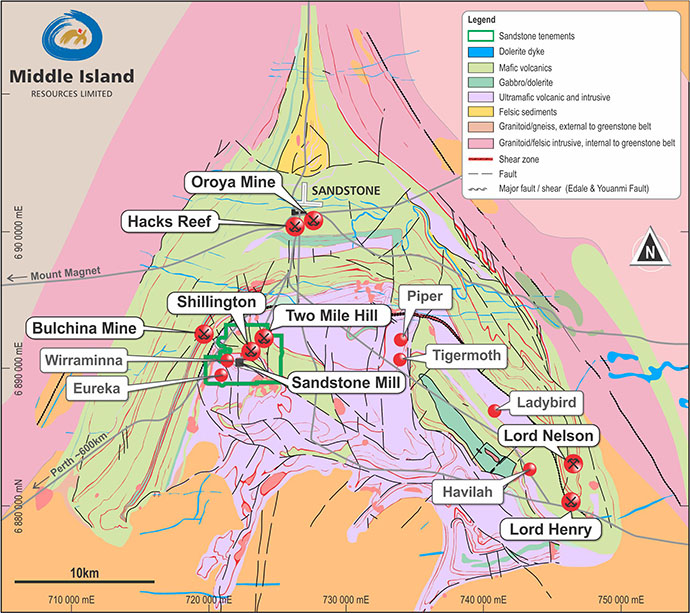

Gold mineralisation is hosted within the Sandstone greenstone belt (Figure 1) within the Southern Cross Province that forms the central spine of the Archaean Yilgarn Block. The Sandstone greenstone belt forms a classic ‘hourglass’ structure at the northern end of the Diemals Dome, where two major trans-current structures, the Edale and Youanmi faults, respectively confine the eastern and western margins of the belt.

Mineral Resources

The updated Resource Statement is included in the table below. These Indicated and Inferred Mineral Resources (JORC 2012), comprise an aggregate of 17.2Mt at 1.13g/t Au for 624,000ozs of gold are estimated by recognised independent industry consultants.

The Company is progressively upgrading and expanding the JORC 2004 resources to JORC 2012 standard and continuing to make new gold discoveries.

Mineral Resources applicable to the Sandstone gold project as at 31 March 2021 are as follows:

Sandstone Underground Deposits – Summary Mineral Resource Estimates (2012 JORC Code)

| Sandstone Open Pit Deposits – Summary Mineral Resource Estimates (2012 JORC Code) at 0.5g/t cut-off | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Deposit | Indicated | Inferred | Total | ||||||

| Tonnes | Au | Au | Tonnes | Au | Au | Tonnes | Au | Au | |

| kt | g/t | Oz | kt | g/t | Oz | kt | g/t | Oz | |

| Two Mile Hill1 | 1,901 | 1.1 | 66,000 | 178 | 0.8 | 5,000 | 2,078 | 1.1 | 71,000 |

| Wirraminna3 | 300 | 1.3 | 12,100 | 280 | 1.1 | 9,700 | 580 | 1.2 | 21,800 |

| Shillington3 | 1,440 | 1.2 | 57,200 | 830 | 1.1 | 29,300 | 2,270 | 1.2 | 86,500 |

| Old Town Well5 | 282 | 1.0 | 8,800 | 68 | 0.6 | 1,400 | 351 | 0.9 | 10,100 |

| Plum Pudding5 | 384 | 1.1 | 13,100 | 35 | 0.9 | 1,000 | 419 | 1.1 | 14,100 |

| Twin Shafts4 | 149 | 1.0 | 4,700 | 37 | 0.7 | 900 | 186 | 0.9 | 5,600 |

| Goat Farm4 | 398 | 1.0 | 13,200 | 398 | 1.0 | 13,200 | |||

| McIntyre4 | 496 | 1.2 | 19,400 | 67 | 0.9 | 1,900 | 562 | 1.2 | 21,300 |

| Ridge6 | 173 | 1.2 | 6,700 | 67 | 1.9 | 4,000 | 240 | 1.4 | 10,700 |

| McClaren6 | 236 | 1.4 | 10,600 | 60 | 1.7 | 3,200 | 296 | 1.5 | 13,800 |

| Open Pit Sub Total | 5,361 | 1.2 | 198,600 | 2,020 | 1.1 | 69,600 | 7,380 | 1.2 | 268,100 |

| Sandstone Underground Deposits – Summary Mineral Resource Estimates (2012 JORC Code) | |||||||||

| Two Mile Hill2 | 14,000 | 1.1 | 480,000 | 14,000 | 1.1 | 480,000 | |||

| Two Mile Hill – BIF2 | 200 | 3.1 | 20,000 | 200 | 3.1 | 20,000 | |||

| Underground Subtotal | 14,200 | 1.1 | 500,000 | 14,200 | 1.1 | 500,000 | |||

| TOTAL | 5,361 | 1.2 | 198,600 | 16,220 | 1.2 | 569,600 | 21,580 | 1.2 | 768,100 |

The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimates, which may result in some computational discrepancies.

*The Two Mile Hill Tonalite Deeps and BIF Deeps have been reported within optimised wireframes. All wireframes include waste and have an aggregate grade at or above the cut-off of 0.64og/t Au.

This Statement includes information extracted from the Company’s previous ASX announcements, which are available to view on the Company’s website, as follows:

1 ASX Release dated 14 December 2016.

2 ASX Release dated 14 April 2020.

3 ASX Release dated 24 July 2020.

4 ASX Release dated 2 October 2020.

5 ASX Release dated 21 October 2020.

6 ASX Release dated 17 November 2020

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements and that all material and assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed. The Company confirms that the form and context in which any Competent Person’s findings are presented have not been materially modified from the original market announcements.

In addition to the Mineral Resources reported above, the residual portion of the Two Mile Hill tonalite deeps Exploration Target, lying between 500m and 700m below surface, is not included and remains to be re-quantified as an Exploration Target or, with further drilling, a Mineral Resource.

There are no Ore Reserves currently reported in relation to the Sandstone gold project.

In all cases, Mineral Resources are estimated and reported in accordance with the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (the JORC Code). Information in this release relating to Mineral Resources is based on, and fairly reflects, information and supporting documentation variously prepared by Mr Brett Gossage of EGRM Consulting Pty Ltd, Mr Shaun Searle of Ashmore Advisory Pty Ltd and Ms Lisa Bascombe of Mining Plus Pty Ltd on behalf of Middle Island Resources Limited. The Competent Persons’ are Members of the Australasian Institute of Mining and Metallurgy (AusIMM) or the Australian Institute of Geoscientists (AIG) and qualify as Competent Persons’ as defined in the JORC Code.

Governance and Internal Controls

Middle Island Resources Limited has a firm policy to only utilise the services of external independent consultants to estimate Mineral Resources. The Company also has established practices and procedures to monitor the quality of data applied in Mineral Resource estimation, and to commission and oversee the work undertaken by external independent consultants.

Mineral Resources reported in accordance with the 2012 Edition were prepared by Mr Brett Gossage of EGRM Consulting Pty Ltd, Mr Shaun Searle of Ashmore Advisory Pty Ltd and Ms Lisa Bascombe of MiningPlus Pty Ltd on behalf of Middle Island Resources Limited.

The Competent Persons in each case are Members of the Australasian Institute of Mining and Metallurgy (AusIMM) or the Australian Institute of Geoscientists (AIG) and qualify as a Competent Persons as defined in the JORC Code.

Processing Plant & Infrastructure

The processing plant was constructed in 1994 with a capacity of 250,000tpa and upgraded to 600,000tpa facility by Troy in 1999 (Figure 2). Troy operated the plant from 1999 to 2010, processing a total of 4.4Mt of ore to produce ~508,000 ounces of gold at an average grade of 3.6g/t Au. The plant was placed on care and maintenance in September 2010 and has not operated since.

The plant has a conventional grinding and milling circuit and carbon-in-pulp (CIP) leach circuit. It is in a reasonable condition, with refurbishment and upgrade costs of A$8.05M estimated by a recognised independent process engineering firm in late 2016, plus estimated owner’s costs of a further A$1.28M.

The processing plant is supported by a contracted diesel-generated power plant, fuel tanks, all associated workshops and offices, and a substantial inventory of equipment and spares (Figure 3). The current permitted in-pit tailings facility has approximately 6 months’ capacity which, along with a permitted bore field, lies proximal to the processing plant.

A 57-person owner’s camp, a 36-person contractor’s camp, and an 8-person exploration camp and core farm are all located on freehold titles within the village of Sandstone, 12km north of the plant. Sandstone also has a well-maintained airport capable of servicing FIFO operations.

Exploration Potential

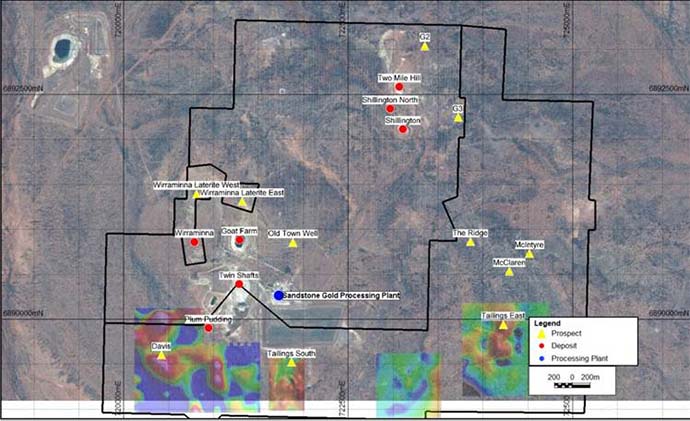

The 2020 drilling campaign, exclusively focused on open pit targets, has tested some 14 gold deposits and prospects, all within 4km of the Company’s 100%-owned gold processing plant and the majority on existing Mining Leases.

In the case of existing deposits, comprising six in total, drilling is designed to variously extend Mineral Resources, reclassify Mineral Resources from Inferred to Indicated status, and/or upgrade JORC 2004 Mineral Resources to JORC 2012 compliance. These comprise the Two Mile Hill, Shillington, Wirraminna, Goat Farm, Twin Shafts and Plum Pudding deposits.

The additional eight prospects assessed by RC drilling represent those which have had little or no existing drilling, but represent targets prioritised on the basis of their interpreted potential to generate open pit gold mineral resources. These targets variously include the Ridge, McIntyre, McClaren, Old Town Well, Wirraminna Laterite (East & West), Davis, Tailings (South & East) prospects, and the G2 & G3 gravity targets.

The various deposits and prospects assessed by the Phase 1 RC drilling are shown in Figure 4 below.

The results to date have proved remarkably successful. In addition to upgrading and/or extending existing Mineral Resources, drilling has identified a further five new satellite gold deposits at McClaren, McIntyre, Ridge, Old Town Well and Plum Pudding. Further drilling to infill and extend these deposits is progressing in advance of an updated feasibility study to be completed later in 2020.

Two Mile Hill Tonalite Deeps

In addition to the open pit deposits, two underground deposits have been identified at Two Mile Hill deeps.

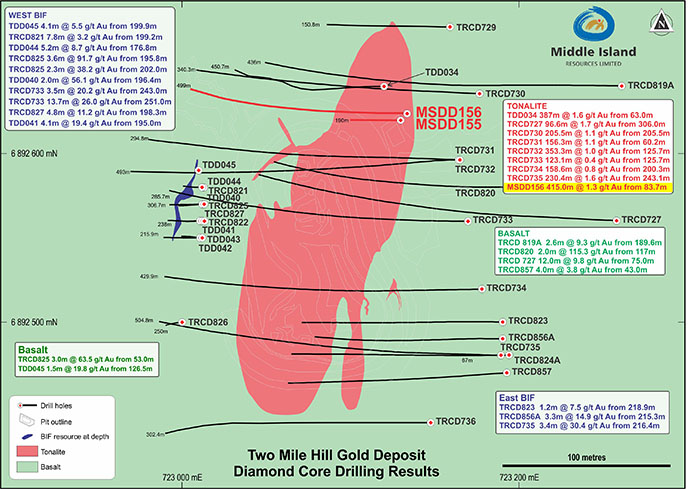

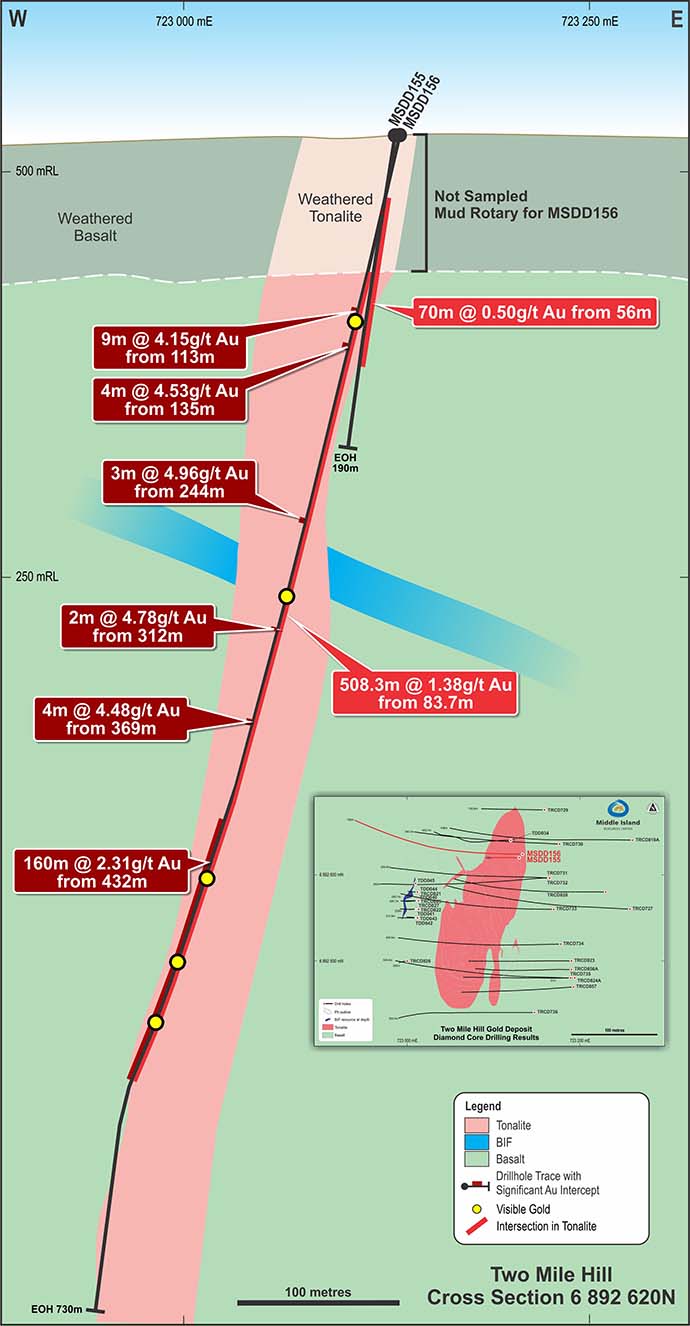

The first and largest of these is the Two Mile Hill tonalite deeps deposit, which comprises a ubiquitously altered and intensely stockwork veined, intrusive stock or plug that at surface measures 250m long, 80-90m wide and extends to at least 700m depth (Figure 5). This target includes drill intercepts of 508.3m at 1.38g/t, 141m at 2.30g/t, 353.3m at 1.04g/t and 156.3m at 1.14g/t Au, as shown in Figure 6 below.

Metallurgical testwork identifies that gravity gold recoveries of >58% can be anticipated prior to leaching. The overall gold recoveries range from 93% to 97%, with ~90% leach extraction being achieved within just two hours following gravity gold recovery. A moderate Bond work index of 16.4kWh/t, low reagent consumptions and no deleterious elements indicates that the material is metallurgically consistent with the Company’s Sandstone processing plant.

Recent mineralogical testwork indicates that in excess of 99% of the gold is hosted by the quartz veins, with quartz vein composite samples averaging 34.8g/t Au, while tonalite-only composites averaged 0.15g/t Au. Ore sorting trials indicate that up to a 257% increase in grade may be achieved at gold recoveries in excess of 93%, and that up to 64% of the sorter feed material may be rejected delivering significant economic benefits to bulk underground mining of the tonalite deeps deposit. Despite the substantial scale of the Two Mile Hill tonalite deposit, the ore sorting concept could prove more compatible with the milling capacity of the Sandstone processing plant.

Two Mile Hill BIF

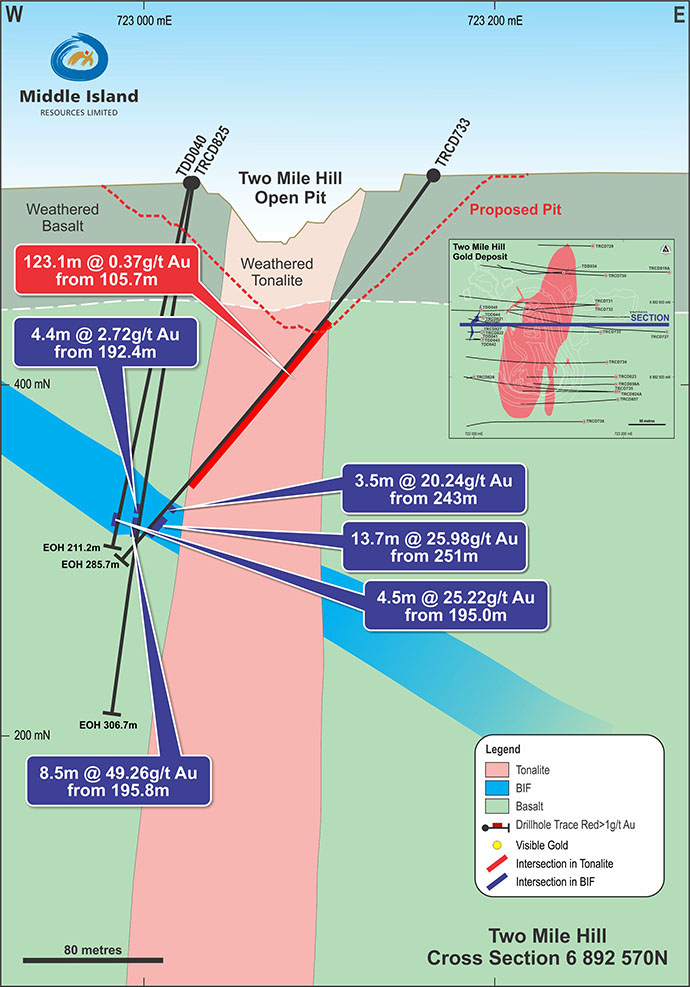

The second underground target is the Two Mile Hill BIF deposit, which is hosted by a banded iron formation (BIF), which obliquely intersects and is intruded by the Two Mile Hill tonalite at depth, is also very strongly mineralised. Drilling within the BIF adjacent to the tonalite includes intercepts (essentially true widths) of 8.5m at 49g/t, 13.7m at 26g/t, 4.5m at 25g/t and 3.5m at 20g/t Au at a depth of some 200m below surface, as shown in Figure 7 below.

Extensions and repetitions of this significant style of mineralisation remain to be fully defined and tested around the margins of the tonalite intrusive, and a further two BIF units have been identified by drilling and geophysics at deeper levels adjacent to the tonalite.

Pre-feasibility Study

Following infill drilling and a resource upgrade of the Two Mile Hill and Shillington open pit deposits in late 2016, a pre-feasibility study (PFS) at a gold price of A$1,600/oz was undertaken to assess the potential to recommission the Sandstone operation. The PFS concluded that, while successful on an operational basis, the economics were insufficient to support the capital required to recommission the project on the basis of the Two Mile Hill and Shillington open pit deposits in isolation.

As such, a successful recommissioning and operation would be dependent on a dual strategy involving either the consolidation of stranded third-party deposits within the district and/or the identification of additional Mineral Resources within the Sandstone project itself.

Some 13 stranded gold deposits, aggregating 1.8Moz gold, predominantly held by three parties have been identified within a 100km radius of the Company’s Sandstone processing plant, within potential economic trucking distance. It was determined that the successful consolidation of one or more of these opportunities would likely justify a project recommissioning decision.

Equally, the Company embarked on an exploration campaign to identify additional targets within its existing tenure to achieve the same outcome. While some 30 exploration targets were progressively identified, this latter strategy required access to sufficient capital to be able to assess these targets in a systematic manner.

The two elements of this dual strategy were developed simultaneously, but prioritised depending on the status of junior equity markets at any particular time.

Access to significant capital in late 2019/early 2020, provided to catalyst to commence a major drilling campaign to assess 14 priority exploration targets and deposit extensions. This campaign is proving remarkably successful and is anticipated to lead to a significant enhancement of the open pit inventory in advance of a feasibility study update later in 2020.

Perfomance

31,000

Ounces of gold produced in 2013